Tenant background checks are your best defence against late rent, property damage, and the nightmare of eviction. It's the essential process of vetting potential tenants—looking into their credit history, confirming their employment, and checking up on their past rental behaviour—to find someone reliable who will treat your property with respect.

Setting the Stage for Lawful Tenant Screening

Before you even glance at an application, let alone run a credit check, you need to get your own house in order. Laying the proper legal groundwork isn't just bureaucratic box-ticking; it's about protecting your investment, treating everyone fairly, and starting a potential tenancy on the right foot. A bit of preparation now saves a world of legal trouble later.

Your first move? Create a standardised application process. Every single person who wants to rent your property should fill out the exact same form. This isn't just for consistency; it's your shield against accusations of discrimination. Your application needs to be crystal clear about the information you require to make a fair decision.

Obtaining Explicit and Informed Consent

Here’s the golden rule you can't afford to break: you must get an applicant's explicit, written permission before you run any checks. In the UK, the General Data Protection Regulation (GDPR) is incredibly strict on this. Without clear, signed consent, you're breaking the law.

A quick chat or a verbal 'okay' is worthless in a dispute. You need a signed declaration, usually as part of the rental application itself, that specifically allows you to perform checks like credit reports and reference calls. This piece of paper is your non-negotiable proof that you've done things by the book.

Don't be vague in your consent form. Transparency is key to building trust and demonstrating professionalism. Tell them exactly what you intend to do. For example, state that you will be conducting:

- A Credit History Check through a recognised credit agency.

- Employment and Income Verification, which involves contacting their employer.

- Previous Landlord References to discuss their tenancy history.

- The legally required Right to Rent Check.

Being upfront like this means there are no surprises for the applicant. If you want to dive deeper into the specifics of data handling, you'll find valuable guidance on https://www.ukprivateinvestigators.com/tag/gdpr-compliance/.

To make this absolutely clear, here's a quick checklist to run through before you start any formal background screening.

Your Pre-Screening Landlord Checklist

| Action Item | Why It's Critical | Relevant UK Legislation |

|---|---|---|

| Create a Standard Application Form | Ensures you apply the same criteria to every applicant, preventing discrimination claims. | Equality Act 2010 |

| Get Signed, Written Consent | Legally required to access personal data for background checks. A verbal 'yes' is not enough. | GDPR, Data Protection Act 2018 |

| Clearly List All Planned Checks | Builds trust and ensures the applicant gives informed consent for each specific action. | GDPR (Principle of Transparency) |

| Verify Your 'Right to Rent' Duties | It's a legal requirement to check if a tenant can legally rent residential property in England. | Immigration Act 2014 |

Completing these steps isn't just about avoiding fines; it's about creating a robust, fair, and defensible process for choosing the best possible tenant for your property.

Why This Foundation Matters

Putting this legal framework in place is about more than just staying on the right side of the law. It’s about making sound, well-informed decisions you can stand by. A consistent process ensures every applicant is measured by the same yardstick, which is the very heart of fair housing practice.

While our focus here is on residential tenancies, the core principles of careful vetting are just as vital when it comes to finding the right tenant for your commercial property. By setting clear, lawful expectations from day one, you establish a professional relationship and put yourself in the strongest position to secure a fantastic, long-term tenant.

What a Proper Background Check Actually Looks Like

Once you've got your applicant's permission in writing, the real work begins. A thorough tenant background check isn't just about glancing at a credit score; it’s about piecing together a complete picture of the person you’re trusting with your property. Getting this right means looking at several key areas of an applicant's background.

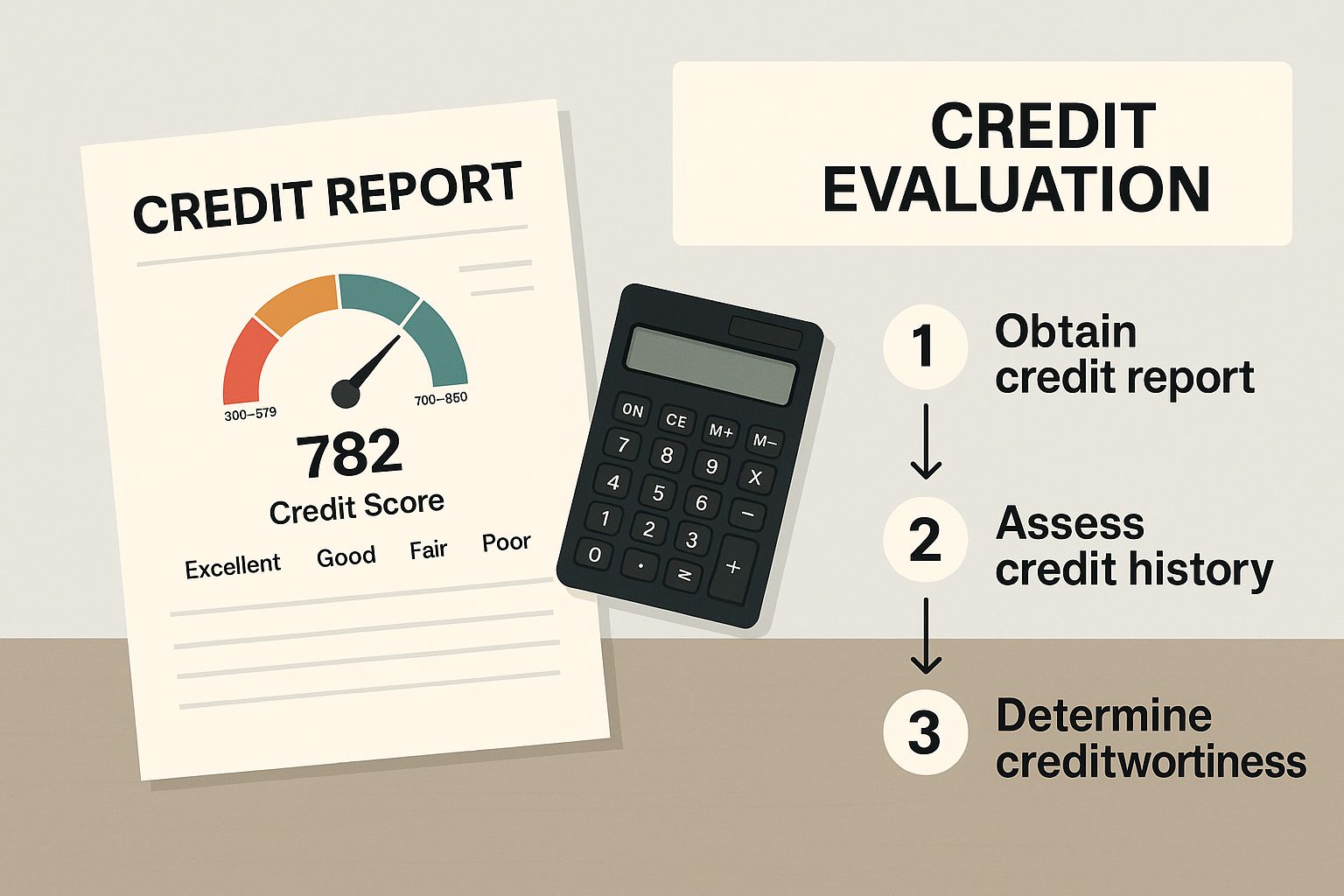

Most landlords start with credit history, but simply looking at the three-digit score is a rookie mistake. You need to get your hands on the full report and understand the story behind that number. Keep an eye out for red flags like County Court Judgements (CCJs), a history of late payments, or significant unsecured debt, as these can all point to financial instability.

The image below breaks down what a comprehensive credit evaluation really involves.

As you can see, the credit report is just the starting line for a much deeper financial check.

Verifying Employment and Affordability

A decent credit history is a good sign, but it doesn’t guarantee they can pay the rent next month. That's why your next step is to confirm their employment and actually verify their income. This is your affordability check, and it's all about making sure their earnings can comfortably cover the rent and their other outgoings.

A solid rule of thumb is to look for a gross monthly income that is at least 2.5 to 3 times the monthly rent.

Don't just take payslips at face value, either. A quick, professional call to their employer’s HR department can confirm their job title, how long they've worked there, and their salary. This simple step is surprisingly effective at weeding out applicants who've fudged the numbers on their application.

The Mandatory Right to Rent Check

If your property is in England, the 'Right to Rent' check isn't a suggestion—it's a legal requirement. Mess this up, and you could face some serious penalties. Before any tenancy begins, you are legally obligated to check that every adult moving in has the right to rent a residential property in the UK.

This isn't just bureaucratic box-ticking. It’s a legal duty designed to prevent illegal renting. Getting it wrong can lead to unlimited fines or even a prison sentence, so it's one area where you absolutely cannot afford to cut corners.

The UK government has clear guidelines on how to conduct these checks properly, including a list of acceptable documents. For most non-UK nationals, this is now an online process using the government's digital service and a 'share code' provided by the applicant. For UK and Irish citizens, you’ll typically be checking original documents like passports in person. To stay on top of the latest rules, it's worth reading up on how tenant referencing has evolved from experts like Airsat Real Estate.

Getting Honest Landlord References

Finally, never underestimate the power of a quick chat with a previous landlord. This can give you insights that no report ever will. A glowing reference can give you the confidence to proceed, while a hesitant or negative one is a massive red flag.

To get the real story, ask direct, open-ended questions.

- Did they always pay their rent on time?

- How did they leave the property?

- Were there ever any complaints from the neighbours?

- The million-dollar question: Would you rent to them again?

This final piece of the puzzle helps you look beyond the numbers and really understand the person who wants to live in your property.

Leaning on Technology for Smarter Tenant Screening

Let's be honest, the old way of screening tenants is a massive time sink. Manually chasing down references, sifting through mountains of paperwork, and trying to get a straight answer from an employer can feel like a full-time job. Thankfully, modern property technology—often called PropTech—has completely changed the game.

Digital screening platforms are now the standard for a reason. They streamline the entire process, pulling all the crucial information you need into one straightforward report. In just a few minutes, you can get a clear picture of an applicant's credit history, verify their income, and check for any past rental red flags. This isn't just about being faster; it's about getting a deeper, more accurate understanding of who you're renting to.

This move to digital isn't just a trend; it's a heavily backed shift in the industry. Consider this: investment in UK PropTech has exploded from £172.38 million in 2016 to £2.66 billion today. That money is fuelling the development of incredibly sophisticated tools that help landlords like us make smarter, data-driven decisions.

The Power of Automated Analysis

The real magic of these systems is their ability to spot inconsistencies that the human eye would almost certainly miss. They use clever algorithms to cross-reference data from multiple sources, quickly flagging potential fraud or discrepancies between what an applicant has told you and what the official records say.

For instance, a good platform can:

- Analyse bank statements to confirm a consistent income, not just a one-off payslip.

- Detect if identity documents have been digitally altered or are fakes.

- Flag addresses that don't line up with an applicant's stated rental history.

In very rare situations, you might come across an applicant who seems to have vanished or is deliberately hiding their past. If your gut tells you something is seriously off, professional services can trace a person to confirm their identity and background.

Automated screening isn't about replacing your landlord instincts; it's about sharpening them. By letting the tech handle the data-crunching, you have more time to focus on the human side of things, like speaking to references and meeting the applicant in person.

Staying Compliant and Fair

Beyond just making your life easier, using technology is vital for keeping your screening process fair and legally compliant. A standardised digital platform ensures you apply the exact same criteria to every single applicant, which is your best defence against accusations of discrimination.

These platforms are also designed with data protection at their core. They handle sensitive personal information securely, keeping you on the right side of GDPR and the Data Protection Act. By automating the screening, you create a consistent, repeatable, and defensible process. It not only protects you legally but also helps you build a reputation as a professional landlord, which ultimately attracts better tenants.

How to Handle Red Flags and Screening Issues

Let's be realistic: the "perfect" tenant on paper is a rare find. Sooner or later, you'll come across an application that gives you pause. What do you do? The applicant looks good, but they have a low credit score, a gap in their employment history, or a reference from a previous landlord that feels a bit… lukewarm.

The knee-jerk reaction for many landlords is to simply bin the application and move on to the next one. But hold on. A more measured approach can uncover a fantastic tenant who just happens to have a small blemish on their record. A red flag isn't an automatic "no". Think of it as a signal to dig a little deeper and get the full story.

Investigating Common Screening Concerns

Let's take a common scenario. An applicant has a credit score that's lower than your usual threshold. Is it a sign of chronic financial irresponsibility? Or could it be the lingering ghost of a business that failed a decade ago, or a messy divorce that’s long since been resolved? They might have a flawless payment history for the last five years, but that old issue is still dragging down their score.

It's the same with employment gaps. A six-month break could easily be explained by travel, going back to college, or caring for a sick family member. Instead of jumping to conclusions, your job is to gather the facts.

The key is to approach these conversations professionally and consistently. Treat every applicant with a similar issue in exactly the same way to avoid any suggestion of discrimination. Your process should be about understanding context, not just reacting to a number on a report.

When you do need to ask those follow-up questions, keep the conversation focused, calm, and respectful. It’s not an interrogation.

Here’s how you might phrase it:

- For a low credit score: "I've reviewed your application and noticed the credit score is a bit below our usual requirement. Would you be able to provide some context on what might have caused this and the steps you've taken to improve things since?"

- For an employment gap: "Your application shows a gap in employment between [Date] and [Date]. Could you tell me a little more about that period, please?"

Consistency Is Your Best Defence

Your decision-making process must be absolutely consistent. If you give one applicant the chance to explain a low credit score, you must offer the same opportunity to every other applicant in a similar position. No exceptions.

Always document your conversations and the reasoning behind your final decision, whether you approve or deny the tenancy. This paper trail is your best evidence that you run a fair and non-discriminatory screening process.

In those rare, complex cases where information seems intentionally hidden or is proving impossible to verify, it can be helpful to understand what a private investigator can do. Knowing what’s possible can give you insight into more advanced verification methods.

By handling red flags with care and consistency, you not only protect your investment but also ensure you're treating every potential tenant fairly and legally. And that’s the foundation of being a professional, reputable landlord.

Making Your Final Decision with Confidence

You’ve gathered all the background information, and now it’s decision time. The secret to making a good call is to look at the whole picture, not just one isolated detail like a credit score. A truly professional assessment means weighing everything you've learned about the applicant.

Think about it this way: you might have an applicant whose income is a little on the lower side, but they have a spotless rental history and fantastic references. That pattern suggests someone who is incredibly responsible with their money and makes paying rent their top priority. Stepping back to see the complete profile helps you spot these kinds of nuances and choose a tenant based on a balanced view of their reliability.

Handling Applicant Data The Right Way

After you've picked your tenant, your legal responsibilities—especially under GDPR—are far from over. The way you handle the data for everyone who applied, both successful and not, is a massive deal. It’s not just about being organised; it's a legal requirement that protects their privacy and your business.

For the tenant you approve:

- Their application and screening reports should be stored securely as part of their official tenancy file.

- Make sure you only keep this data for as long as it's truly necessary for the tenancy.

- If the files are digital, they need to be password-protected. For physical copies, a locked cabinet is a must.

For applicants you reject:

- You are legally required to securely and permanently destroy their personal information. This isn't optional. Physical documents must be shredded, and digital files need to be properly deleted.

- Resist the temptation to hold onto their applications "just in case." This directly violates GDPR, which is very clear that data shouldn't be kept longer than needed.

Your responsibility for an applicant's sensitive information doesn't end when you turn them down. Proper data disposal is a non-negotiable part of a compliant screening process. Getting this wrong can lead to some seriously hefty penalties.

Communicating Your Decision Professionally

It’s quite common for an unsuccessful applicant to ask why they weren't chosen. When this happens, you need to be ready with a clear, lawful, and non-discriminatory reason. Never be vague or, worse, ignore them.

Your explanation should always tie back to the consistent criteria you set from the start. For example, you could calmly explain that their "verified income didn't meet the minimum affordability threshold" or that "the information from a previous landlord reference unfortunately did not meet our requirements."

By communicating clearly and handling their data with care, you close out the process on a professional note. This approach not only protects your investment but also builds your reputation as a fair and trustworthy landlord.

Common Questions About Tenant Background Checks

Even with a well-oiled screening process, you'll inevitably run into some tricky questions. Certain situations always seem to crop up, especially when you’re dealing with applicants who don't fit the standard mould.

Let's walk through some of the most common queries I hear from fellow landlords about tenant background checks, covering everything from timings and costs to handling applicants from overseas. Getting these details right is key to keeping your process fair, compliant, and professional from start to finish.

How Do You Screen International Applicants?

Screening an applicant who doesn't have a UK credit or rental history can feel like you're trying to piece together a puzzle with half the pieces missing. But it's absolutely doable—you just need to adjust your approach.

Instead of hitting a dead end with standard UK checks, here's what you should be asking for:

- Proof of 'Right to Rent': This isn't optional; it's the mandatory first step for every single tenancy in England. No exceptions.

- Employment Confirmation: A formal letter from their UK employer is crucial. It needs to detail their role, salary, and the length of their contract.

- Bank Statements: Ask for the last three to six months of bank statements. You're looking for a consistent financial history and proof that they have sufficient funds.

- A UK Guarantor: This is your best safety net. Requesting a UK-based guarantor, ideally a homeowner, gives you solid financial recourse if things go wrong.

Putting this evidence together helps you build a clear picture of their financial stability, even without a traditional UK footprint.

How Long Does a Tenant Background Check Take?

The time it takes to complete a background check can vary wildly. If you're going the old-school, DIY route—making phone calls to employers and previous landlords—you could be waiting for a week or more. It all depends on how quickly people get back to you.

Thankfully, modern screening services have completely changed the game.

Using a digital tenant screening platform, you can often get a comprehensive report covering credit, references, and affordability back within 24 to 48 hours. Some of the faster services can even provide initial results in minutes, letting you make confident decisions without the long wait.

Who Is Responsible for Paying for the Checks?

This one is black and white. The Tenant Fees Act 2019 made it illegal for landlords or letting agents in England to charge tenants for any referencing or admin fees.

That means the landlord is responsible for paying the full cost of any tenant background checks. You simply can't pass this cost on to the applicant, even if their application fails. It's just one of the standard business costs of being a landlord, so be sure to factor it into your budget.

What Is the Average Cost of a Check?

You can expect a tenant background check in the UK to cost somewhere between £20 and £50 per applicant. A basic check at the lower end of that scale will likely just cover a credit report and Right to Rent verification. The more comprehensive services will dig deeper, including employment and income verification, plus references from previous landlords.

When you think about the potential cost of a bad tenancy, this is a small price to pay for peace of mind. The sheer prevalence of tenancy fraud really drives this point home. A shocking 91% of detected fraud cases involved tenants providing false or misleading information, a figure that highlights just how vital thorough vetting is. If you're interested, you can read more about the rise of advanced tenant verification tools.

Ultimately, investing in a quality check is your best defence against a world of future problems.

When you need to verify information with absolute certainty, UK Private Investigators offers discreet and professional background check services tailored to your specific needs. Ensure you have all the facts before making your final decision by visiting https://www.ukprivateinvestigators.com.