Protecting your rental property starts long before a tenant moves in. The single most important step you can take is a thorough tenant screening background check. This isn’t just about a quick look at their credit; it’s a deep dive into an applicant’s identity, financial health, criminal history, and past rental behaviour to make sure they’re a reliable and trustworthy choice.

Building Your Compliant Tenant Screening Framework

Before you even think about posting that rental advert, you need a plan. A structured, compliant screening framework is your best defence against potential headaches down the line. This isn’t about creating barriers; it’s about being diligent, fair, and professional.

A solid framework protects you legally and sets the stage for a stable, positive tenancy. The foundation of all this is a set of clear, objective, and legally sound rental criteria that you apply to every single applicant, without exception.

Establish Your Minimum Criteria

First things first, get your standards down on paper. What does a good tenant look like for your property? Documenting this eliminates any guesswork and, crucially, ensures you treat everyone equally, which is your best defence against any accusations of discrimination.

Think about setting clear benchmarks for:

- Minimum Income: The industry standard is a good place to start. A common rule of thumb is that an applicant’s gross monthly income should be at least three times the monthly rent.

- Credit Expectations: You’re not necessarily looking for a perfect score, but you might decide on a minimum threshold. More importantly, you could specify that applicants should have no recent County Court Judgements (CCJs) or bankruptcies.

- Rental History: A positive reference from a previous landlord is gold dust. You should be looking for confirmation of on-time rent payments and no history of evictions or significant property damage.

The Importance of Consistency

Let me be clear: applying your criteria consistently is non-negotiable. If you set an income-to-rent ratio of 3x for one person, you must apply that same standard to everyone else.

Making exceptions, even if your gut tells you to, can easily be misinterpreted as discriminatory and land you in serious legal hot water. My advice? Keep a written record of your criteria and a simple checklist to show how each applicant measured up.

A consistent, documented process is your strongest evidence of fair practice. It moves your decision-making from subjective feelings to objective facts, protecting you from potential discrimination allegations.

Designing the Application Form

Your application form is your main information-gathering tool. It needs to be detailed enough to give you a clear picture of the applicant but must not stray into illegal territory by asking discriminatory questions.

If you’re unsure about what a comprehensive check involves, it’s worth taking the time to learn more about the specifics of background checks to ensure your process is watertight.

Crucially, your application form must include a clear section where the applicant gives you explicit, written consent to run background and credit checks. This isn’t just a formality; it’s a mandatory step for GDPR compliance in the UK. Without that signature, you cannot legally proceed with your checks. It confirms they understand and agree to the screening process, protecting both of you.

Staying Compliant: A Landlord’s Guide to UK Screening Laws

As a landlord in the UK, getting to grips with your legal duties isn’t just a box-ticking exercise—it’s absolutely fundamental. A slip-up during the tenant screening process can lead to some pretty hefty penalties, so it’s vital to handle this stage with care to protect both your property investment and your good name.

The law is there to make sure everything is fair, non-discriminatory, and respectful of applicants’ privacy. It’s a balancing act between gathering the information you need and protecting personal data.

One of the biggest legal hurdles is the Right to Rent check, mandated by the Immigration Act 2014. Before you hand over the keys, you are legally required to verify that your prospective tenant has the legal right to live in the UK. Getting this wrong can result in substantial fines or, in serious cases, even a prison sentence. It’s a non-negotiable part of the process.

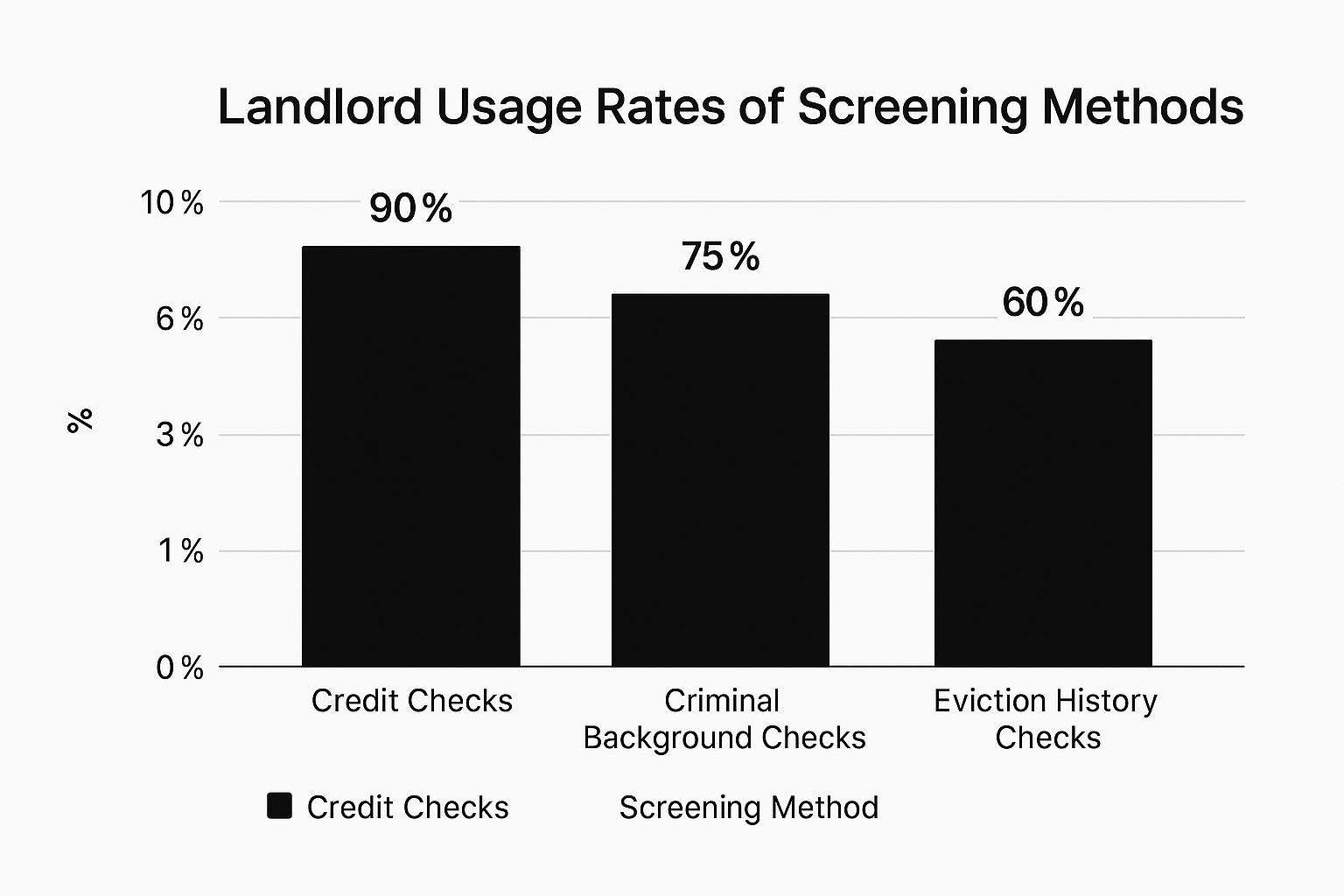

The checks landlords prioritise tell a clear story about what’s important for a secure tenancy.

As you can see, while financial health is the number one concern, a huge number of landlords also dig into criminal records and eviction history to get a well-rounded view of who they’re renting to.

Handling Data The Right Way With GDPR

Immigration status is just the start. Your obligations under the General Data Protection Regulation (GDPR) are just as serious. From the moment you take an application, you are handling sensitive personal information—names, addresses, employment details, financial history—and that makes you a data controller.

This isn’t a role to be taken lightly. It comes with some very clear rules:

- Have a Good Reason: You must have a lawful basis for collecting data. For landlords, this is typically the applicant’s consent given on the application form to assess their suitability.

- Collect Only What You Need: Stick to the essentials. Don’t ask for intrusive details that have no real bearing on whether they’ll be a good tenant. This principle is known as data minimisation.

- Keep It Safe: All that personal data must be stored securely. That means a locked filing cabinet for paper copies or an encrypted, password-protected folder for digital files.

- Dispose of It Properly: When you no longer need the information—say, after a tenancy has ended or you’ve rejected an application—you can’t just throw it away. Paperwork should be shredded, and digital files must be permanently deleted.

To help clarify these responsibilities, here’s a quick summary of the key legal points you need to know.

Key Legal Obligations for UK Landlords During Screening

| Legal Requirement | Governing Legislation | Key Landlord Responsibility | Potential Penalty for Non-Compliance |

|---|---|---|---|

| Right to Rent Checks | Immigration Act 2014 & 2016 | Verify every adult tenant’s legal right to reside in the UK before the tenancy begins. | Unlimited fines and/or up to 5 years in prison. |

| Data Protection | General Data Protection Regulation (GDPR) | Lawfully collect, store, and dispose of applicant data. Only gather what is necessary. | Fines of up to £17.5 million or 4% of annual global turnover. |

| Anti-Discrimination | Equality Act 2010 | Ensure screening criteria are objective and applied consistently to all applicants, without bias. | Unlimited compensation claims from applicants, legal fees, and reputational damage. |

| Tenant Fees | Tenant Fees Act 2019 (England) | Only charge permitted fees (e.g., rent, deposit). The cost of referencing cannot be passed to the tenant. | Initial fine of up to £5,000, with further breaches leading to fines of £30,000 or criminal prosecution. |

Adhering to these regulations is not just about avoiding penalties; it’s about operating a professional and ethical rental business.

Don’t Cross The Line Into Discrimination

There’s a fine line between doing your due diligence and discriminating against an applicant, and it’s a line you must never, ever cross. Your rental criteria need to be objective, directly relevant to the tenancy, and applied exactly the same way for every single person who applies.

It’s illegal to make a decision based on protected characteristics. In the UK, this includes age, disability, gender reassignment, race, religion or belief, and sexual orientation. Your final choice must be based solely on whether the applicant meets your predefined tenancy criteria—like affordability and references.

Managing the legal and financial side of being a landlord means staying informed on all fronts. This includes understanding things like available rental property tax deductions just as much as your screening duties. For a more detailed look into how these checks are carried out, you can learn more about how do background checks work. Keeping yourself educated is the best way to build a screening process that is both effective and fully compliant with UK law.

Assessing an Applicant’s Financial Stability

Let’s be honest, the single most important factor in a successful tenancy is whether the rent gets paid on time, every time. A tenant’s ability to consistently meet their rent obligation is what keeps your investment secure. While a credit score offers a quick glimpse, the full credit report is where the real story of their financial habits unfolds.

This part of your screening process is also your first line of defence against tenancy fraud, which has unfortunately become a significant issue for UK landlords. To give you some perspective, a 2023 report found that a shocking 91% of all tenancy fraud involved applicants using false or misleading information. It’s a sobering statistic that highlights just how vital thorough financial checks are.

Looking Beyond the Credit Score

A credit score is just a number. It’s the details behind that number that paint a complete picture of an applicant’s financial responsibility. Once you have an applicant’s consent to run a check, you’re not just looking at the score; you’re looking for patterns and red flags that might signal trouble ahead.

Here’s what I always focus on:

- Payment History: Are they consistently paying their bills on time? A few isolated late payments over several years might be explained, but a pattern of defaults on credit cards, loans, or other bills is a major concern.

- County Court Judgements (CCJs): A CCJ is a court order to repay a debt and it’s a serious indicator of financial distress. If you see one, especially if it’s recent or still unpaid, you need to proceed with extreme caution.

- Overall Debt Level: Take a look at their total debt compared to their stated income. Even with a good salary, someone carrying a mountain of debt might struggle to afford the rent on top of their other obligations.

Verifying Income Effectively

Simply looking at a payslip isn’t enough. You need solid proof that an applicant’s income is stable, reliable, and more than enough to cover the rent. A widely accepted benchmark in the industry is an income that’s at least three times the monthly rent.

For applicants in traditional employment, ask for their last three months of payslips and perhaps a recent P60. The crucial next step, however, is to contact their employer directly. A quick call can confirm their employment status, role, and salary, and it’s the best way to catch out fabricated documents.

Landlord Tip: Never use the contact number the applicant gives you for their employer. It could easily be a friend waiting on the other end of the line. Always find the company’s official number online through an independent search to make sure you’re speaking to the right person.

Handling Non-Traditional Income Sources

What about self-employed applicants or freelancers? Their income won’t be as straightforward as a monthly payslip, so you have to dig a bit deeper to gauge their financial stability.

Instead of payslips, you should ask for:

- Tax Returns: At least two years of their self-assessment tax returns (the SA100 forms) provide an official record of their earnings over time.

- Accountant’s Reference: A formal letter from their accountant can confirm their income and give you confidence in the viability of their business.

- Bank Statements: Reviewing the last six months of their business or personal bank statements can reveal a consistent cash flow and responsible financial management.

Since you’ll be handling sensitive financial documents, it’s vital to know how to spot fake bank statements. For an even more secure method, you can (with explicit consent) use Open Banking services. These tools connect directly to an applicant’s bank account to provide a tamper-proof view of their financial history, making it easy to spot red flags that paper documents might hide. A thorough financial deep dive like this is what sets the stage for a secure and successful tenancy.

Looking Beyond the Financials at Tenant History

An applicant’s financial health is a massive piece of the puzzle, but it doesn’t tell the whole story. A strong income doesn’t automatically mean they’ll respect the property, communicate well, or be a considerate neighbour. This is where digging into their rental and personal history gives you the crucial context you need.

A thorough history check helps you find someone who will be a responsible steward of your property, not just someone who can pay the rent. It’s about building a complete picture to minimise future headaches and protect your investment.

The Art of Checking References

Speaking directly with a previous landlord is, in my experience, one of the most revealing parts of the entire screening process. This is your golden opportunity to get a firsthand account of what the applicant is really like to deal with day-to-day. A five-minute phone call can honestly tell you more than a credit report ever could.

To get the most out of this conversation, you need to go beyond the simple question, “Were they a good tenant?”

- Ask specific, targeted questions: “Did they consistently pay rent on or before the due date?” “Were there ever any complaints from neighbours about noise or other issues?” “How was the property left when they moved out?”

- Verify the details: Double-check the dates they lived at the property and the monthly rent they paid. This simple step helps confirm you’re speaking to a legitimate previous landlord and not just a mate doing them a favour.

- Listen to what isn’t said: Hesitation or vague, rambling answers to questions about property condition or payment history can be just as telling as a directly negative response. Trust your gut.

Landlord Tip: Be wary of references that seem over-the-top enthusiastic. A genuine landlord reference is usually professional and factual. If it sounds too good to be true, it might just be a friend on the other end of the line.

Spotting Potential Red Flags in Tenant History

Uncovering an applicant’s past is a key part of any solid tenant screening background check. By 2023, these checks had become a cornerstone of the market, driven by landlords needing to identify serious criminal histories and past eviction records. These verifications are vital for preventing lost income, property damage, and legal dramas. Modern tools, often powered by AI, are making these evaluations faster and more accurate than ever. If you’re interested in the market trends, you can learn more about the evolution of tenant screening services.

A crucial area to examine is the criminal background check, but it’s vital to approach this both ethically and legally. You should only consider offences that are directly relevant to a tenancy, such as a history of property damage, theft, or violence. A minor, old offence that poses no conceivable risk to the property or neighbours shouldn’t be grounds for an automatic rejection. The goal here is to assess tangible risk, not to pass moral judgement.

Taking a balanced view—considering the nature and recency of any convictions—is the key to a fair and compliant process.

To help clarify what each check is for, here’s a quick comparison of the most common ones.

Tenant Screening Check Comparison

| Type of Check | Primary Purpose | Key Information Revealed |

|---|---|---|

| Previous Landlord Reference | To verify rental conduct and reliability. | Payment timeliness, property care, communication style, and reason for leaving. |

| Criminal Background Check | To assess potential risks to the property and community. | Relevant convictions (e.g., property damage, theft, serious offences). |

| Right to Rent Check | To comply with UK immigration law. | The applicant’s legal status and permission to rent property in the UK. |

By combining the financial data with a deep dive into an applicant’s history, you move from simply assessing their ability to pay to truly understanding their potential as a responsible tenant. This holistic view is the secret to making a letting decision you can feel genuinely confident about.

Making an Informed and Fair Letting Decision

You’ve done the legwork and gathered all the reports and references. Now comes the crucial part: putting all the pieces together to make a confident, well-rounded decision. It’s rarely about finding a “perfect” tenant because, let’s be honest, they’re few and far between. This is about assessing the complete picture to find the right fit for your property.

Think of it like building a profile. The credit report lays the financial foundation, their income verification shows stability, and the landlord references add the all-important colour and context about their character as a tenant. You have to step back and look at the whole portrait, not just a single brushstroke.

Weighing the Different Factors

It’s a balancing act. I’ve seen countless applicants with a slightly bruised credit history but who come with glowing references and a solid, long-term job. In a case like that, the positive aspects can easily outweigh a past financial hiccup. On the flip side, someone with a flawless credit score but a vague or hesitant reference from their last landlord? That’s a red flag that warrants a closer look.

This is where your pre-defined rental criteria become your best friend. It keeps the process objective. You should be able to score each applicant against your own benchmarks:

- Affordability: Do they comfortably meet your income-to-rent threshold?

- Credit History: Are there any serious warning signs, like County Court Judgements (CCJs) or a pattern of late payments?

- Rental History: What was the honest feedback from their previous landlord?

- Stability: How long have they been with their current employer?

Remember, a tenancy is a business arrangement. Understanding the numbers, like calculating rental yield, helps you keep the bigger financial picture in mind when making these key decisions.

Communicating Your Decision Professionally

Once you’ve settled on a candidate, clear communication is everything. If you’re accepting their application, get in touch with them promptly. Share the good news and clearly lay out what happens next. It shows you’re organised and professional, starting the tenancy on the right foot.

Handling rejections requires a bit more finesse. While you aren’t legally required to give a detailed reason, a polite and professional message is simply good practice. A straightforward, “Thank you for your interest, but we have decided to move forward with another applicant,” is perfectly adequate. It’s respectful and helps sidestep any potential for awkwardness or disputes. This final stage is where the real value of comprehensive https://www.ukprivateinvestigators.com/relationship/background-checks/ becomes clear.

Always tie your decision back to the objective criteria you set out from the very beginning. Keeping a brief, factual record of why you chose one applicant over others, based on those criteria, is your best defence against any accusations of discrimination.

Finalising the Tenancy

With your ideal tenant approved, it’s time to get the formal paperwork sorted. This is the moment where all your diligent screening really pays off, paving the way for a smooth and compliant tenancy.

Make sure you have all the necessary documents ready to go:

- A signed tenancy agreement that clearly details all the terms.

- Information on the deposit protection scheme you’ll be using.

- A copy of the property’s Energy Performance Certificate (EPC) and Gas Safety Certificate.

- The latest version of the government’s ‘How to Rent’ guide.

Having this organised and ready to share sets a professional tone from the get-go and ensures you’re starting the tenancy in full compliance with the law.

Common Questions About Tenant Background Checks

As a landlord, wading through the rules of tenant background checks can feel a bit daunting. You’re bound to have questions, and that’s perfectly normal. Getting the right answers is crucial for protecting your property while staying on the right side of the law.

Let’s tackle some of the most frequent queries that pop up, from dealing with fees to handling applicants with a less-than-perfect financial history.

Can I Charge Tenants for Background Checks in the UK?

This one is a hard and fast no. The Tenant Fees Act 2019 completely changed the game in England, making it illegal for landlords or letting agents to charge tenants for referencing, credit checks, or any other admin related to starting a tenancy.

You’ll need to cover these costs yourself. It’s simply part of the running costs of being a modern landlord. Similar rules are in place across Wales, Scotland, and Northern Ireland, so this is standard practice throughout the UK.

Forget about passing on referencing costs. The law is crystal clear: the landlord is responsible for paying for all tenant screening and background checks.

What Should I Do If a Tenant Fails a Right to Rent Check?

If an applicant fails a Right to Rent check, there’s no grey area here. You are legally required to stop the application process immediately. Renting to someone who doesn’t have the right to be in the UK is a serious criminal offence, and you could face huge fines or even prison time.

Not only must you reject them, but you also have a legal duty to report the failed check to the Home Office. For your own records and protection, document everything: the check you ran, the documents provided, and exactly why they failed.

How Do I Handle an Applicant with No Credit History?

Don’t panic if an applicant has a ‘thin file’ or no credit history at all. This is actually quite common, especially with younger people leaving university, recent graduates, or someone who has just moved to the UK. It’s not necessarily a red flag.

Instead of rejecting them out of hand, you just need to shift your focus and dig a little deeper in other areas.

- Employment and Income: Take extra care to verify their job and income. You need to be confident they can comfortably cover the rent each month.

- Ask for a Guarantor: This is your best move. A guarantor—ideally a UK homeowner with a solid credit history—is a fantastic safety net. They sign a legal agreement to pay the rent if your tenant can’t, giving you peace of mind.

This approach allows you to be flexible and fair to a good applicant without taking on unnecessary financial risk.

Finding the perfect tenant is about being thorough and professional. If you’re dealing with a complex application or just want complete certainty, the expert team at UK Private Investigators can deliver in-depth background checks to help you make the right call. You can find out more by visiting their website at https://www.ukprivateinvestigators.com.