Think of tenant background verification as your first line of defence. It’s the process landlords use to get a clear picture of a potential renter, making sure they’re reliable, financially stable, and likely to treat your property with respect. It's less about being suspicious and more about being smart with your investment.

Why Tenant Background Verification Matters

Letting a property is a bit like hiring a key employee. You wouldn't fill a critical role without checking references or reviewing their CV, right? The same logic applies to the person who will be living in what is likely one of your most valuable assets. A thorough tenant background verification process is simply foundational to good property management.

This initial due diligence isn't just about weeding out "bad" tenants. It’s about building the groundwork for a stable, professional, and profitable relationship. When you do your checks properly, you can have real confidence in a tenant's ability to hold up their end of the bargain.

The Core Pillars of Protection

A structured approach to vetting applicants moves your decision-making away from gut feelings and towards objective facts. It helps you manage the most common risks landlords face. The main benefits really boil down to three things:

- Ensuring Consistent Rental Income: Confirming a tenant's income and employment history is the best way to know if they can comfortably afford the rent, which is the number one guard against late payments and arrears.

- Minimising Property Damage: What does their track record look like? Speaking to previous landlords gives you invaluable insight into how an applicant has treated properties in the past.

- Maintaining a Safe Environment: Especially in multi-unit buildings, proper screening helps create a secure and peaceful community for everyone living there.

The Rising Importance of Digital Verification

Let’s be honest: in the current UK rental market, tenant fraud is a genuine problem. A 2023 report revealed a shocking statistic: 91% of all detected rental fraud cases involved applicants providing false or misleading information. We’re talking about everything from fabricated landlord references to doctored bank statements and payslips.

This is where modern digital verification tools have become essential. They cross-reference information directly with credit agencies and other official sources (always with the applicant's consent, of course), making it much harder for inconsistencies to slip through the cracks.

Choosing a tenant is one of the most significant decisions a landlord makes. A robust verification process transforms it from a game of chance into a calculated business decision, safeguarding your income, property, and peace of mind.

Ultimately, you need the complete picture of an applicant to make a sound decision. A comprehensive background report check can provide a level of detail that goes far beyond standard screening.

Understanding Your Legal Obligations in the UK

As a landlord in the UK, staying on the right side of the law isn't just a good idea—it’s an absolute necessity. The world of tenant verification is governed by a strict legal framework, and getting it wrong can lead to some seriously painful consequences. Think of it less like paperwork and more like the foundation of a secure, lawful, and successful tenancy.

Let’s break down exactly what you need to know.

The Right to Rent Checks

First and foremost are the Right to Rent checks. These are not optional. Under Home Office rules, every private landlord in England must verify that a potential tenant has the legal right to live in the UK.

This isn't a simple glance at a passport. You have to check original documents from an approved list, and you must do this with the applicant physically present. The goal is to be certain the documents are genuine and belong to the person in front of you. Skipping this step or doing it improperly can lead to huge fines and, in the worst cases, even a prison sentence.

Data Protection and GDPR

Next up is data. Whenever you handle a prospective tenant's personal information—their name, previous addresses, employment details—you step into the world of the General Data Protection Regulation (GDPR). This means you have a legal duty to manage their data responsibly.

Before you even think about running a credit check or contacting a reference, you must get the applicant's explicit consent. This needs to be a clear, signed agreement that specifically authorises you to carry out the checks. Keeping meticulous, secure records of this consent isn't just good practice; it’s your proof that you’ve followed the rules.

If you want a clearer picture of what a full, compliant check involves, our detailed guide on the background check process is a great place to start.

Upcoming Changes to Sanctions Legislation

The legal landscape is always shifting, and a significant change is on the horizon. Starting from 14 May 2025, all landlords will be required to conduct sanctions checks for every new tenancy.

Previously, these checks were only mandatory for high-value properties, but the government is removing that rent threshold.

This is a major policy shift. It means every landlord, whether you have one flat or a hundred houses, must add sanctions screening to their standard verification process. The aim is to clamp down on illegal financial activity by preventing sanctioned individuals from renting property anywhere in the UK.

The penalties for failing to comply are severe. We're talking about the possibility of unlimited fines, criminal prosecution, and even having your rental income frozen. This makes having a rock-solid, legally compliant tenant screening process more critical than ever.

To help you navigate these duties, here is a quick summary of the essential legal requirements for UK landlords.

Key Legal Requirements for UK Landlords

This table breaks down the core legal duties and the serious consequences of getting them wrong.

| Legal Requirement | What It Involves | Potential Penalty for Non-Compliance |

|---|---|---|

| Right to Rent | Verifying the immigration status of all adult tenants using original, approved documents before the tenancy starts. | Unlimited fines and up to 5 years in prison. |

| GDPR Compliance | Obtaining explicit, written consent from the applicant before collecting or processing their personal data for any checks. | Fines of up to £17.5 million or 4% of global turnover. |

| Sanctions Checks | Screening all tenants against government sanctions lists to ensure you are not letting property to a designated person or entity. | Unlimited fines, criminal prosecution, and freezing of assets (including rental income). |

In short, your legal responsibilities as a landlord are built on these three pillars. Mastering them isn't just about avoiding fines—it's about running a professional, ethical, and secure rental business.

A Practical Guide to the Verification Process

Moving from legal theory to practical action, a structured tenant verification process is your most reliable tool. It’s not about being difficult; it’s about being diligent. Having a consistent, repeatable framework saves time, ensures every applicant is treated fairly, and protects you from potential discrimination claims down the line.

Let's walk through the essential stages you should follow, from the moment an application lands on your desk to the final reference checks.

The entire process kicks off when a prospective tenant submits their application. This form is the cornerstone of your verification, providing the personal details and—most importantly—the signed consent you need under GDPR to proceed. Without that explicit permission, you simply cannot legally access their private information.

Stage 1: The Initial Checks

Once you have consent, the first steps are about covering the foundational, non-negotiable checks. Think of these as quick but critical filters that can immediately identify unsuitable or non-compliant applicants before you invest more of your time and resources.

Top of the list is the Right to Rent check. If your property is in England, this isn't optional—it's a mandatory legal duty. You must physically inspect original identity documents (like a passport or biometric residence permit) with the applicant present to confirm they have a legal right to live in the UK.

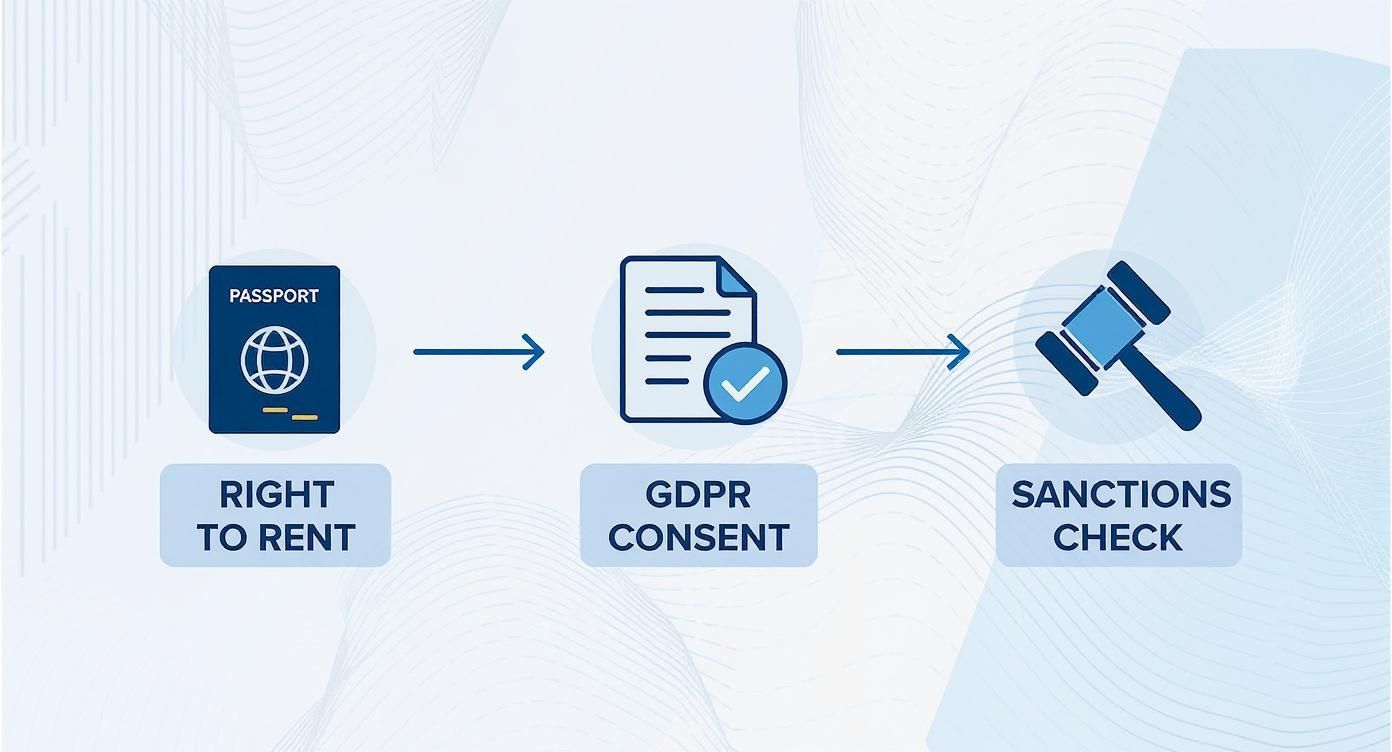

This infographic lays out the core duties every landlord in the UK must fulfil to stay on the right side of the law.

As you can see, legal compliance isn't just one thing. It's a combination of Right to Rent, GDPR, and other checks that form the bedrock of any responsible tenancy agreement.

Stage 2: Financial and Rental History Deep Dive

With the initial legal hurdles cleared, it’s time to assess the applicant's financial stability and their track record as a renter. This is where you get a real insight into their reliability and whether they can consistently meet their rental obligations.

- Credit History Check: A credit report gives you a clear snapshot of an applicant's financial responsibility. You’re looking for red flags like County Court Judgements (CCJs), a pattern of late payments, or unsustainable levels of debt.

- Employment and Income Verification: Never just take their word for it. A quick call to their listed employer can confirm their job title, salary, and how long they've been employed. For self-employed applicants, asking for at least six months of bank statements or their latest tax return is standard practice to verify a consistent income.

- Previous Landlord References: This is arguably one of the most valuable checks you can do. A conversation with a previous landlord tells you things a credit report never will—were they on time with rent? How did they treat the property? What were they like as a neighbour?

A tenant's past behaviour is often the best predictor of their future actions. A glowing reference from a previous landlord carries significant weight, while a hesitant or negative one should prompt further investigation.

Stage 3: Finalising the Decision

By working through these stages systematically, you build a comprehensive profile of each applicant based on factual evidence, not just a gut feeling.

This methodical approach doesn't just help you select the best possible tenant for your property. It also ensures your process is thorough, fair, and legally sound every single time. For a truly deep understanding and a step-by-step approach, you can consult a comprehensive guide on how to screen tenants, which covers applications, background checks, and more.

How to Interpret Screening Results

Getting the tenant verification report back is one thing; knowing what to do with it is another entirely. This is where experience and a sharp eye come in. You're not just ticking boxes; you're piecing together a puzzle to get a clear picture of who might be living in your property.

The key is learning to separate a minor imperfection from a serious warning sign. After all, a single late credit card payment from five years ago is a world away from a recent eviction notice. Context is everything.

Assessing Financial Stability

Let's start with the basics: affordability. A tried-and-tested guideline is the income-to-rent ratio. Can the applicant comfortably afford the rent? The general rule is that their gross monthly income should be at least three times the monthly rent. It’s a simple, effective first check.

But a good salary doesn't automatically mean they're reliable with payments. You need to look at their credit history for behavioural patterns. A history of multiple defaults or consistently missed payments on loans and credit cards suggests a financial discipline issue that could easily extend to their rent.

Reading Between the Lines

References from previous landlords and employers can be pure gold, but you have to know how to listen for what isn't being said. A hesitant or overly brief reference can be just as revealing as a glowing one.

A truly useful reference is packed with specifics. Think "they always paid rent on the first of the month" or "the property was left spotless." Vague comments like "they were an okay tenant" should be a cue to dig a little deeper with some follow-up questions.

It's also crucial to remember who today's renters are. In the UK, the private rental market is dominated by younger demographics, with 32% of lead tenants aged 25 to 34 and another 24% aged 35 to 44. These tenants might not have a long, unbroken rental history to draw from, which means you may need to rely more heavily on other checks.

Identifying Major Red Flags

While every applicant's story is different, certain findings should immediately grab your attention. It helps to categorise these issues to understand the level of risk you might be taking on.

The table below breaks down some common red flags, their potential risk level, and what you should do next.

Red Flag Analysis in Tenant Screening

| Red Flag | Potential Risk Level (Low/Medium/High) | Recommended Action |

|---|---|---|

| Undisclosed CCJs | High | This is a serious indicator of past debt problems. You must discuss the circumstances directly with the applicant. |

| Gaps in Rental History | Medium | Ask for a straightforward explanation. It might be something innocent, like living with family, or it could be hiding a difficult tenancy. |

| Negative Landlord Reference | High | This is one of the most significant warnings. Find out the specifics behind any complaints, especially concerning rent arrears or property damage. |

| Dishonesty on Application | High | Falsifying information breaks trust from day one. It can also be an early sign of more organised deception, like tenancy fraud. |

Trust your gut. If you feel that something is off or that an applicant is being deliberately misleading, don't ignore it. This is particularly important when it comes to potential fraud. If you suspect deception, it's wise to understand your options, which can include professional tenancy fraud investigations.

Ultimately, a thoughtful interpretation of the data is what transforms a simple background check into a powerful tool for protecting your investment and finding a great tenant.

Adopting Best Practices for Tenant Screening

Getting tenant background verification right really boils down to having a professional, consistent, and legally sound system. It's best to think of your screening process not as a chore, but as a core business operation—one that needs to be reliable and fair every single time.

The most important rule? Be consistent. You must apply the exact same screening criteria to every single applicant, without exception.

This isn't just about good practice; it's your primary shield against accusations of discrimination. When you set clear, objective benchmarks for things like credit scores, income levels, and rental history, you can make decisions based on solid evidence. Every applicant is measured against the same yardstick, which keeps your process effective and, crucially, equitable.

Choosing Your Verification Method

A big decision every landlord faces is whether to run the checks themselves or bring in a professional third-party service. Both routes have their pros and cons, and it's worth weighing them up carefully.

- The DIY Approach: At first glance, handling checks yourself looks like a good way to save money. But be warned—it demands a solid grasp of complex rules like GDPR and Right to Rent. On top of that, getting direct access to official credit reports can be a real headache for private landlords.

- Professional Services: These firms are specialists. They live and breathe tenant screening, giving you quick and easy access to comprehensive data. Yes, there's a fee involved, but what you’re really buying is peace of mind, accuracy, and the confidence that you’re ticking all the legal boxes.

For landlords who want to make their lives easier, exploring strategies for easy tenant screening can be a game-changer. These services often deliver a much quicker turnaround, which is a massive advantage in a competitive rental market.

Meticulous Record Keeping

Whichever path you take, keeping organised and secure records is absolutely non-negotiable. Not only is it essential for GDPR compliance, but it’s also your safety net if a dispute ever arises down the line.

Think of your records as a detailed history of your due diligence. Should a tenancy issue arise, a well-documented screening process demonstrates that you acted responsibly and professionally from the very beginning.

This means securely filing away every document related to the verification process, including:

- Signed application forms that show you have explicit consent for the checks.

- Copies of ID documents you used for the Right to Rent verification.

- The final screening reports themselves (credit, references, and so on).

- All your communication with the applicant about the checks.

By combining a consistent process with smart verification methods and meticulous paperwork, you move beyond just being a property owner and become a truly professional landlord. For very complex or high-value tenancies where standard checks might not feel like enough, professional services can offer a much deeper look. Understanding what private investigators can legally do, for example, gives you an idea of the more advanced options available. Ultimately, following these best practices will help you refine your process and operate with confidence.

Common Tenant Verification Questions

Getting to grips with tenant background checks can throw up a lot of questions, especially if you're a new landlord or find yourself in an unusual situation. Getting clear, practical answers is the key to making decisions that are confident, fair, and legally sound.

Here are the answers to some of the most common queries we hear from UK landlords about the screening process.

How Long Does a Typical Tenant Verification Take?

The time it takes to complete a thorough tenant check can really vary. If you’re using a modern digital service, the automated parts—like credit histories and initial ID checks—can often come back within 24 to 48 hours.

But, the whole process can stretch out if it needs a human touch. Actually getting hold of previous landlords or employers for references is what usually extends the timeline, often pushing it to between 3 and 5 working days. The single biggest thing you can do to speed it all up is to have a prepared applicant who gives you all their information and consent forms right from the start.

Can I Reject a Tenant Based on Their Credit Score?

Yes, you absolutely can. It is perfectly legal to turn down an application based on what you find in a credit report, whether that's a low credit score or a County Court Judgement (CCJ). This is a completely standard part of figuring out if someone is financially reliable.

The most important thing here is to be consistent. You need to apply the exact same financial standards to every single person who applies to avoid any suggestion of discrimination.

The best approach is to decide on your minimum creditworthiness criteria before you even start showing the property. This way, you can be sure your decisions are based on objective standards you set in advance, which protects both you and your potential tenants.

What If an Applicant Has No Rental History?

Don't worry, it's incredibly common to get applications from people without a formal rental history. Think of students, recent graduates, or even people who have just sold their own home. This isn't an automatic red flag at all.

When this happens, you just need to shift your focus to other parts of the tenant background check:

- Zero in on affordability. Put more effort into verifying their employment and income to make sure they can comfortably handle the rent each month.

- Ask for a guarantor. This is your best safety net. A guarantor is someone who agrees to cover the rent if the tenant can't, and you'll need to run a credit check on them, too.

- Look at other references. A character reference from a professional contact can still give you a good sense of their reliability.

Do I Need to Redo Checks for a Tenancy Renewal?

It might not be a strict legal requirement for a simple renewal with the same tenant, but it’s something we strongly recommend. A lot can change in a person's life over the course of a tenancy.

It's especially critical to re-check a tenant’s Right to Rent status if their permission to be in the UK is time-limited. Running a fresh credit check is also a smart move to confirm their financial situation is still stable before you lock into another term. For more general queries about our processes, you can find answers by reviewing our frequently asked questions.